About Author

ABOUT AUTHOR

Bill Rapp

Bill Rapp is a seasoned commercial real estate broker and finance expert with over a decade of experience helping clients navigate complex property transactions and capital solutions. Based in Houston, Texas, Bill specializes in investment sales, acquisitions, and commercial financing strategies tailored to meet the needs of investors, developers, and business owners. He brings a

unique blend of market insight, negotiation skills, and financial acumen to every deal, consistently delivering value and growth opportunities for his clients. With a deep knowledge of the Houston and Greater Texas markets, Bill

is committed to building long-term relationships and helping clients make smart, strategic decisions in today’s ever-evolving real estate landscape. When

he’s not closing deals or analyzing the next big opportunity, Bill enjoys time with family, outdoor adventures, and giving back to the local community through mentorship and service.If you’d like, I can help write or edit these based on

the book content we’ve built so far.

- FOLLOW ON SOCIAL -

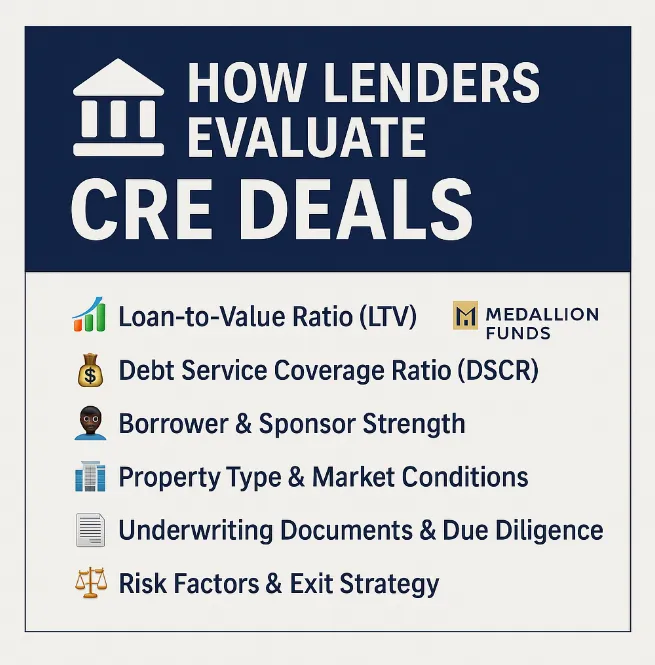

🏦 How Lenders Evaluate CRE Deals | Key Metrics Every Investor Must Know 📊

🏦 How Lenders Evaluate CRE Deals | Key Metrics Every Investor Must Know 📊

💼 Commercial Real Estate Loan Underwriting Explained | What Banks & Lenders Look For 🏢

🏦 How Lenders Evaluate CRE Deals: What Investors Need to Know

When it comes to commercial real estate (CRE) financing, securing the right loan often comes down to how well your deal holds up under a lender’s microscope. Lenders don’t just look at the property itself—they analyze a combination of financial metrics, market conditions, sponsor strength, and risk factors to decide whether to approve your loan.

As a mortgage brokerage, Medallion Funds works with investors, developers, and business owners every day to package their deals in a way that lenders want to see. Let’s break down the key elements lenders evaluate in CRE deals so you can position yourself for success.

📊 1. Loan-to-Value Ratio (LTV)

One of the first things a lender reviews is the Loan-to-Value (LTV) ratio, which measures the loan amount compared to the property’s value.

·Typical LTVs:

oMultifamily/Industrial: 70–80%

oRetail/Office: 65–75%

·Lower LTV = lower risk for the lender.

Tip: A strong appraisal and showing equity skin in the game increase your approval chances.

💰 2. Debt Service Coverage Ratio (DSCR)

The DSCR shows how well the property’s income can cover the loan payments. Most lenders require:

·1.20–1.25 DSCR for stabilized assets

·Higher DSCR for riskier deals like retail or new construction

Formula: Net Operating Income (NOI) ÷ Debt Service = DSCR

Tip: If your DSCR is tight, consider improving NOI by cutting expenses or raising rents before applying.

👤 3. Borrower & Sponsor Strength

Lenders want to know who’s behind the deal:

·Net worth and liquidity relative to loan size

·Real estate experience and track record

·Business plan execution ability

Tip: Partnering with a strong co-sponsor can help if you’re light on experience.

🏢 4. Property Type & Market Conditions

Lenders evaluate both the asset class and the location market:

·Industrial and multifamily: typically favored

·Office and retail: scrutinized more heavily

·Submarket vacancy rates, absorption trends, and local economic drivers

Tip: Be ready to explain why your property and market are positioned for success despite broader trends.

📑 5. Underwriting Documents & Due Diligence

Expect requests for:

·Rent rolls & operating statements

·Leases & tenant financials (for retail/office)

·Appraisal, Phase I ESA, and PCA (Property Condition Assessment)

Tip: Organize your documents early. A clean, complete package signals professionalism and reduces lender hesitation.

⚖️ 6. Risk Factors & Exit Strategy

Finally, lenders consider what could go wrong and how you’ll protect against it.

·Lease rollover risk

·Construction cost overruns

·Market downturns

They’ll also ask: What’s your exit plan? (refinance, sale, or long-term hold).

✅ Takeaway

Understanding how lenders evaluate CRE deals allows you to structure stronger loan requests and move through underwriting faster. At Medallion Funds, we help investors and business owners present deals in the best possible light—maximizing approvals and negotiating the most competitive terms.

📞 Ready to finance your next project? Contact Medallion Funds today for tailored CRE financing solutions.

https://www.billrapponline.com/

https://findamortgagebroker.com/Profile/WilliamRappJr28883

https://billrapp.commloan.com/

https://billrapponline.com/financingfuturescre-houston-katy

https://houstoncommercialmortgage.com/

https://author.billrapponline.com

https://doctorvideo.billrapponline.com/

https://veteransvideo.billrapponline.com/

https://mortgageviking.billrapponline.com/

https://fha203h.billrapponline.com/

https://renovationvideo.billrapponline.com

https://medallionfunds.com/bill-rapp/

https://www.amazon.com/dp/B0F32Z5BH2

https://veed.cello.so/FOmzTty6oi9

© 2023-2024 Bill Rapp, Medallion Funds LLC, Director of Capital Advisory

Our Journey Towards Storytelling Excellence

As an author, I aim to create stories that captivate and inspire. My passion for storytelling drives me to craft unique characters and worlds that leave a lasting impact on readers.

Our Story

Founded with a passion for storytelling, we’ve been empowering aspiring authors to bring their ideas to life and share them with the world.

Our Growth

Since our inception, we’ve helped countless authors find their voice and publish successful books, growing our reach and impact in the literary world.

Our Approach

We focus on personalized coaching, guiding authors through every stage of writing, editing, and publishing, ensuring their creative vision shines.

Our Mission

Our mission is to inspire, educate, and support authors in creating stories that resonate, fostering a community of successful, confident writers.

- LATEST BOOKS -

All Latest Books

Pumpkin Patch Murder

A farm owner investigates a murder at the pumpkin patch just before Halloween, racing to solve the crime before the season is ruined.

Tea and Crime

A café owner investigates a murder after one of her loyal customers is found dead in her shop.

Antique Secrets

An antique store owner uncovers a hidden diary and is drawn into a decades-old mystery.

OUR WORK

What People Are Saying!

"I was hooked from the first page! This author’s storytelling is captivating, and the plot twists kept me on the edge of my seat. Can't wait for the next book!"

Sarah Thompson

"An incredible read! The characters felt so real, and the pacing was perfect. I couldn't put it down. Highly recommend to any mystery lover!"

Lia Johnson

"This author never disappoints! The writing is gripping, the plot unpredictable, and the suspense builds perfectly. Another fantastic book!"

Ethan Clark

Subscribe to Our Newsletter

Frequently Asked Questions

What types of books do you write?

We specialize in a wide range of genres including historical fiction, romance, mystery, fantasy, and more. Our goal is to create stories that captivate and engage readers from all walks of life.

Where can I purchase your books?

Our books are available on major platforms like Amazon, Barnes & Noble, and local bookstores. You can also find them in e-book and audiobook formats for easy access.

Do you offer signed copies of your books?

Subscribe to our newsletter for the latest updates, book releases, and exclusive offers. Follow us on social media to stay connected and receive real-time news.

How can I stay updated on your new releases?

Subscribe to our newsletter for the latest updates, book releases, and exclusive offers. Follow us on social media to stay connected and receive real-time news.

Do you accept book reviews from readers?

Absolutely! We encourage our readers to leave reviews on platforms like Goodreads, Amazon, or personal blogs. Your feedback helps us grow and reach new audiences.

Can I request a book to be personalized?

Yes, we offer personalized book services. Please contact us directly for more information on how we can make your book special.

Drain Repair And Maintenance

You can contact us through our website’s contact page, or by emailing us directly. We love hearing from readers and potential collaborators!

Do you have a fan club or book club?

We have an active community of fans! Join our book club or fan group online to discuss books, share recommendations, and enjoy exclusive content from our latest releases.